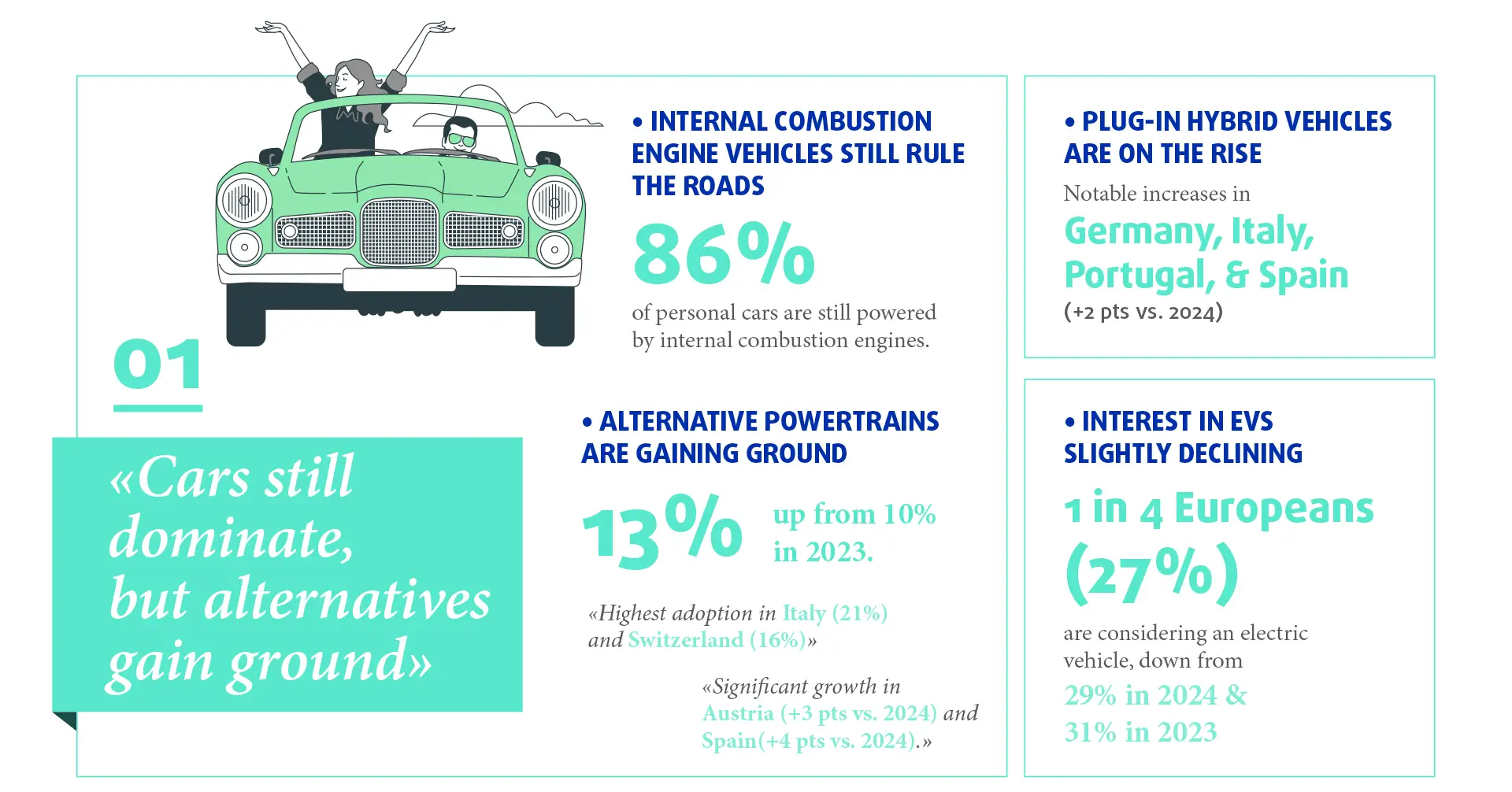

While personal cars remain central in usage (86% of Europeans own at least one car), those cars are relying more and more on electric and other alternative powertrains (13% in 2025 vs 10% in 2023), with hybrid and electric models even progressing in specific countries.

Besides EV, there is a rise in usage of soft mobility solutions (such as electric bikes, public transport or shared services) underlying a gradual transition towards more sustainable and cost-effective alternatives: 60% of Europeans say they have already changed their daily mobility habits towards greener alternatives.

Personal cars still dominant, but new alternatives are emerging

While the use of personal cars remains central, the 2025 Mobility Barometer highlights a shift in car purchase intentions.

- Internal Combustion Engine (ICE) vehicles remain dominant (representing 86% of personal cars), but ownership of hybrid and electric models is progressing in specific countries (+ 2 pts vs. 2024 for plug-in hybrid vehicles in Germany, Italy, Portugal and Spain).

- Overall, alternative powertrains are particularly popular in Italy and Switzerland (21% and 16% of all powertrains respectively) and growing in Austria and Spain (+3 and + 4 points vs 2024).

- 1 in 4 Europeans (27%) is still considering purchasing an electric vehicle (vs. 29% in 2024 and 31% in 2023). The slight decrease over the last 3 years suggests a plateau in the market potential for EV.

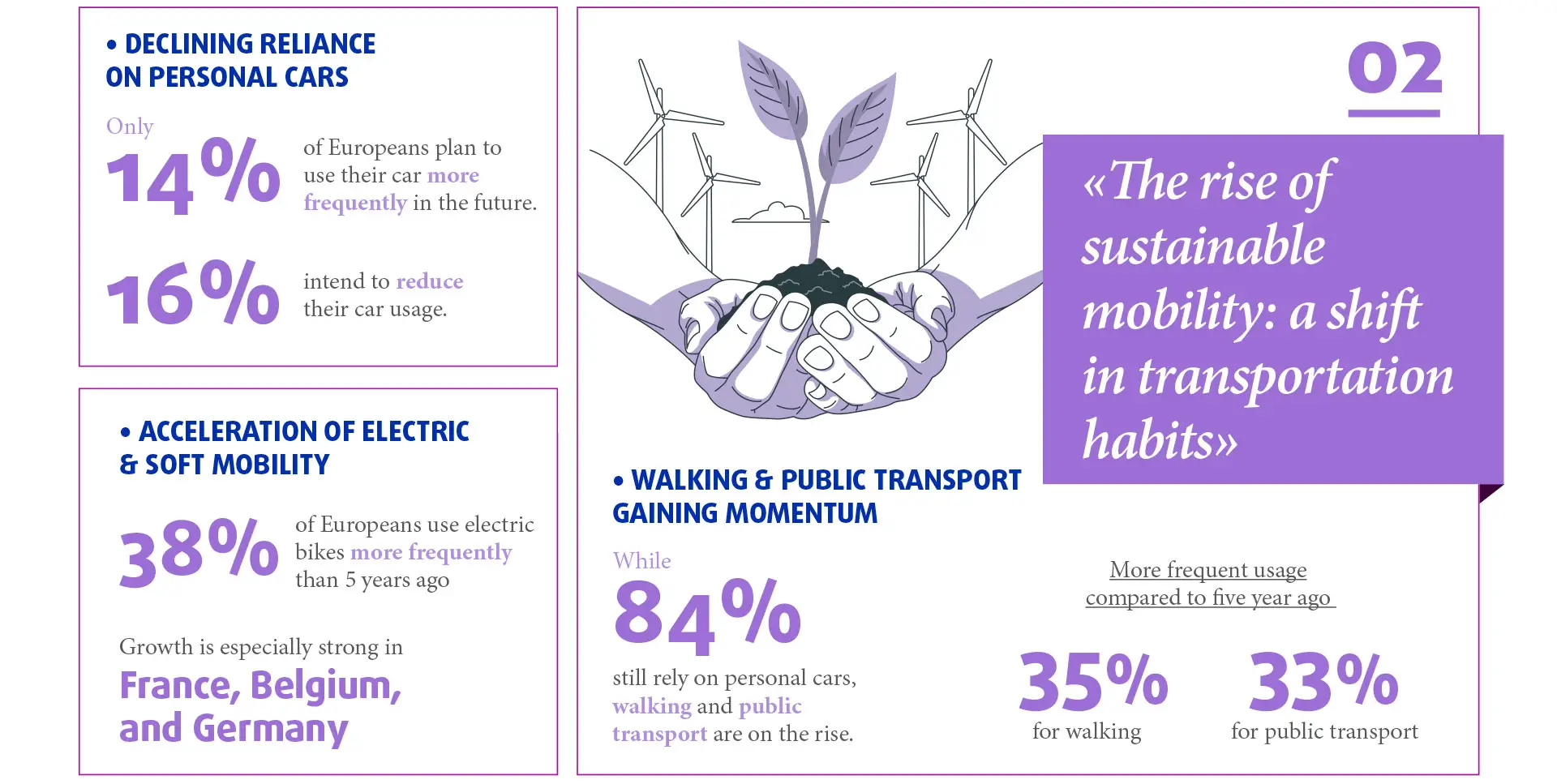

Alternative means of transportation are progressing towards more sustainable mobility

- When asked about future usage, only 14% of Europeans plan to use their car more frequently in the future, whereas 16% intend to reduce their usage.

- While the private car remains the preferred means of transport for Europeans (84% are using personal cars), alternative, more sustainable models are progressing:

- The study reveals that along with walking (93%), personal cars (80%) are among the main modes of transport on weekdays. However, walking and public transportation have gained in popularity, with a more frequent usage than five years ago (35% for walking, 33% for public transport)

- Changes are underway particularly in Spain and Austria, where public transport is gaining popularity (59% of weekday use in Spain +2 pts vs 2024, 72% in Austria +3 pts vs 2024).

- 2025 trends confirm a strong growth in alternative electric and soft mobility: the use of electric bicycles has increased, with 38% of Europeans using them more frequently than five years ago (among current users). This growth is particularly strong in France, Belgium, and Germany.

- The high level of interest in insurance and assistance services for bicycles and micromobility, with more than half of bicycle owners planning to use such services, reflects the growing importance of these new forms of mobility in people’s daily lives.

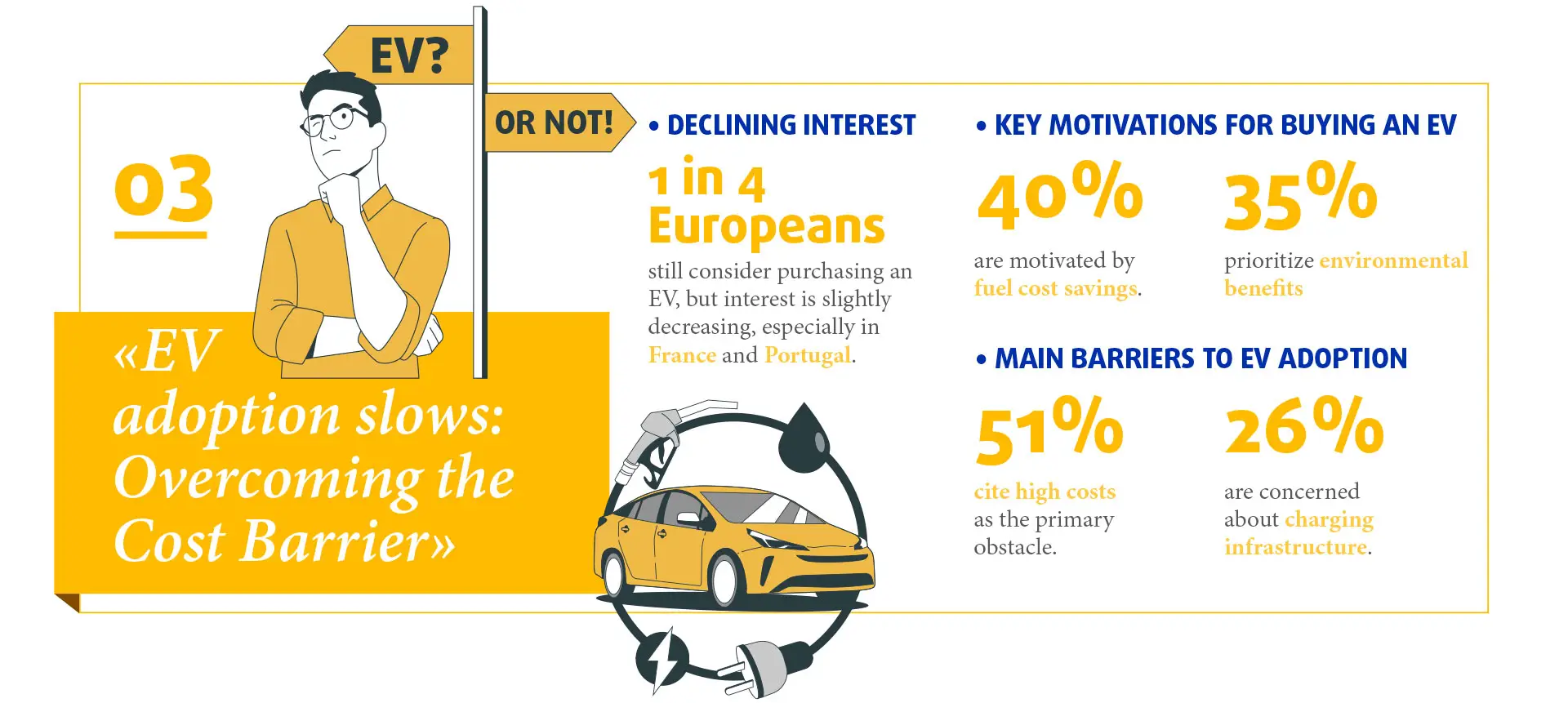

EV adoption showing signs of slowing down: a cost barrier to overcome

While one in four Europeans is still considering purchasing an electric vehicle, interest has slightly declined compared to last year, particularly in France and Portugal. This signals the need for stronger incentives and infrastructure improvements to support the transition to electric mobility.

- Indeed, the primary barrier to considering an EV remains costs (51%) followed by charging points issues (26%).

- On the other hand, motivations for buying an EV are driven primarily by cost savings on fuel (40%), closely followed by environmental concerns (35%).

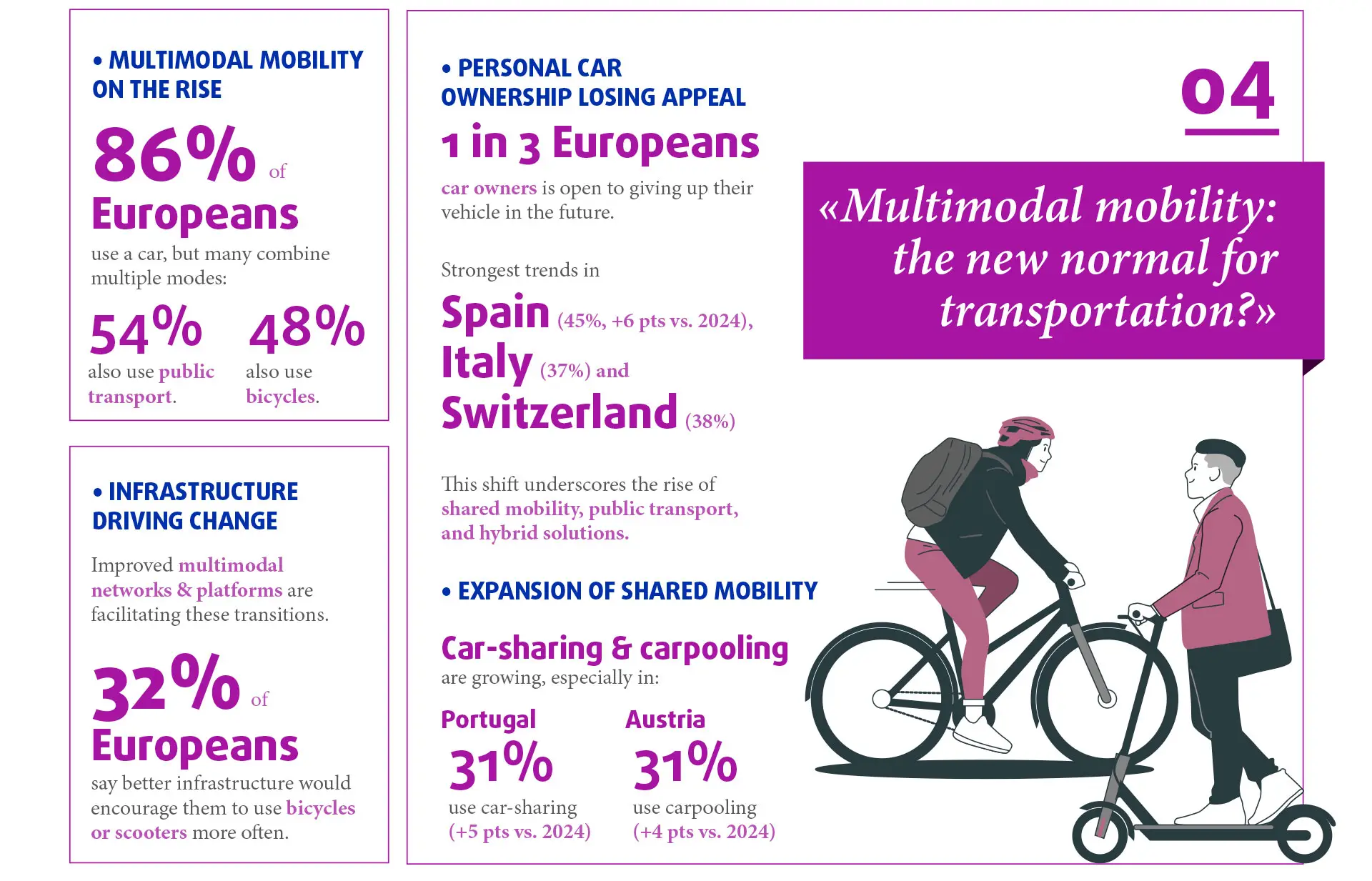

Multi-Modal transportation: hybrid and shared as a new normal?

A significant shift is emerging in the mindsets regarding car ownership: in 2025 one in three European car owners is open to giving up their personal vehicle in the future, a trend particularly strong in Spain (45%, + 6 pts vs 2024), Italy (37%) and Switzerland (38%). In 2024 it was 30%: this trend is consolidating at a European level. This highlights the growing role of shared and hybrid mobility, as well as public transport, as viable alternatives to car ownership.

The study highlights a growing trend of combining multiple transport modes based on needs and constraints:

- A majority of Europeans alternate between cars, public transport, and soft mobility solutions (bicycles, scooters, walking) depending on their journeys. Indeed, 86% of Europeans are car users, of which 54% also use public transportation, and 48% also use a bicycle. Mixed and multimodal mobility is widespread in Europe.

- The expansion of multimodal infrastructure and mobility platforms is making these transitions easier. Indeed, improved infrastructures are among the first motivations to support the use of personal bicycles or stand scooters (32% of the respondents say it would influence positively their usage).

- Carpooling and car-sharing continue to gain traction, particularly in Spain, Austria and Portugal, where shared mobility solutions are expanding (31% for car-sharing in Portugal, + 5 pts vs 2024, 31% carpooling in Austria, + 4 pts vs 2024).

Methodology

The survey was conducted by Ipsos, a global market research firm, among 9,000 people across 9 countries in Europe: Belgium, France, Germany, Italy, Portugal, Spain, Austria, Czech Republic and Switzerland. It tracks Europeans’ mobility habits. The survey was taken between December 17th, 2024 – January 13th, 2025.

The evolutions (+x pts/-x pts) presented with the 2024 results are based only on the same 8 countries tested in 2024 and 2025. The 2025 results presented for Europe are based on the 9 countries tested in 2025.